- A wave of selling in a handful of stocks on Friday was sparked by a $20 billion margin call for Archegos Capital.

- Archegos is the family office of former Tiger Management portfolio manager Bill Hwang.

- These are the 8 stocks that plummeted on Friday as margin calls led to a $20 billion forced liquidation of Archegos Capital.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

A wave of multi-billion share blocks for a handful of stocks hit the market on Friday as Archegos Capital was hit with a $20 billion margin call.

The highly-leveraged firm, which is the family office of former Tiger Management trader Bill Hwang, was forced to liquidate its stocks as a number of positions moved against it. Banks including Goldman Sachs, Morgan Stanley, and Credit Suisse offered numerous share blocks that led to a precipitous decline in several US and Chinese stocks on Friday.

More than $35 billion in market value was wiped away from these stocks as the selling intensified on Friday.

These are the 8 stocks that plummeted on Friday as margin calls led to a $20 billion forced liquidation of Archegos Capital.

8. Baidu

Ticker: BIDU

Friday Gain: 2%. Baidu was down as much as 8% before recovering late Friday.

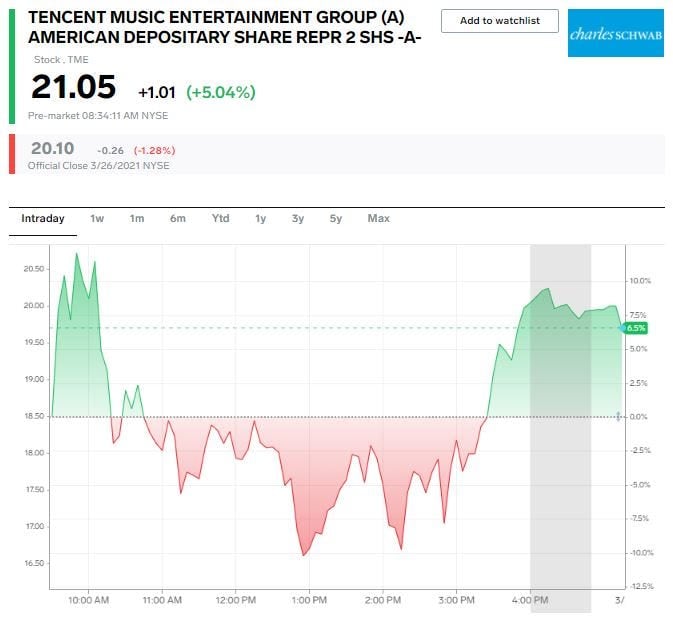

7. Tencent Music Entertainment

Ticker: TME

Friday Decline: 1%

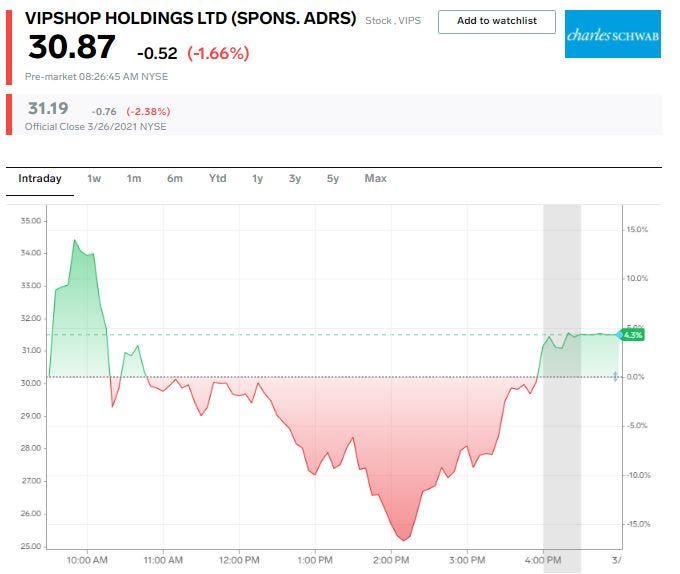

6. Vipshop Holdings

Ticker: VIPS

Friday Decline: 2%

5. Farfetch

Ticker: FTCH

Friday Decline: 2%

4. iQIYI

Ticker: IQ

Friday Decline: 13%

3. ViacomCBS

Ticker: VIAC

Friday Decline: 27%

2. Discovery Inc.

Ticker: DISCA

Friday Decline: 27%

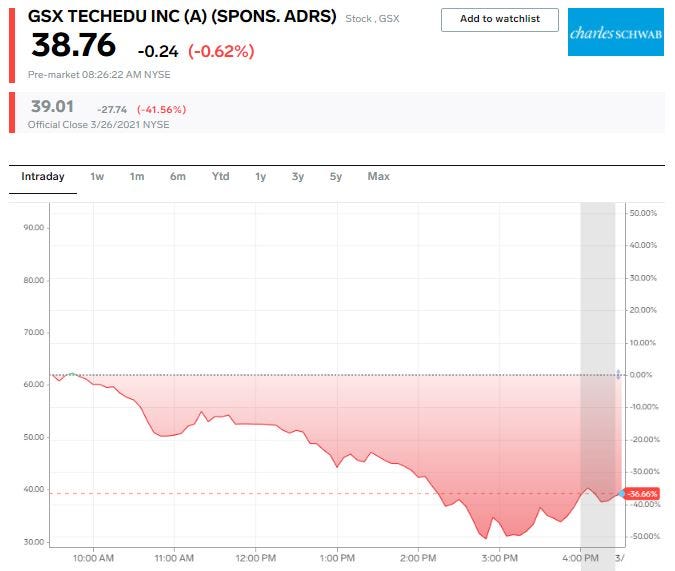

1. GSX Techedu

Ticker: GSX

Friday Decline: 42%